Re: 1 lakh to 652 lakhs in 497 trading days - Winning 20% of Trade in NIFTY Futures -

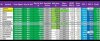

The Risk Value is introduced so that we can take safe position. Remember the LONG or SHORT positions are generated using the LOW and HIGH Price of the Day. So if you have missed the boat then you will be wondering whether to enter the position now...

You can always enter the position using the column "Add more @", when it says "BUY MORE" or "SELL MORE".

In the Pivot based system the concept is,

We initially enter a position, and then Add positions...

Now coming to the Risk part, Let us say you are buying NIFTY. The LONG call was generated at 5700, Between what price you will enter ? If your risk is 10% of the profit (1% of the Price), then you can take a risk of say 5.7 points for NIFTY. so you will buy in the Range of 5700-5705.7... If the price is well above 5705.7 then it is not falling within the 10% Risk Range....

The Same will hold true for the "Add more @" positions also...

Sir with these question, can you please mention how risk value effect buy/sell call in StockTracker sheet with changing value of Pivot and Flow using minute timing.

Thank's

Thank's

You can always enter the position using the column "Add more @", when it says "BUY MORE" or "SELL MORE".

In the Pivot based system the concept is,

We initially enter a position, and then Add positions...

Now coming to the Risk part, Let us say you are buying NIFTY. The LONG call was generated at 5700, Between what price you will enter ? If your risk is 10% of the profit (1% of the Price), then you can take a risk of say 5.7 points for NIFTY. so you will buy in the Range of 5700-5705.7... If the price is well above 5705.7 then it is not falling within the 10% Risk Range....

The Same will hold true for the "Add more @" positions also...