ST bro and traders,

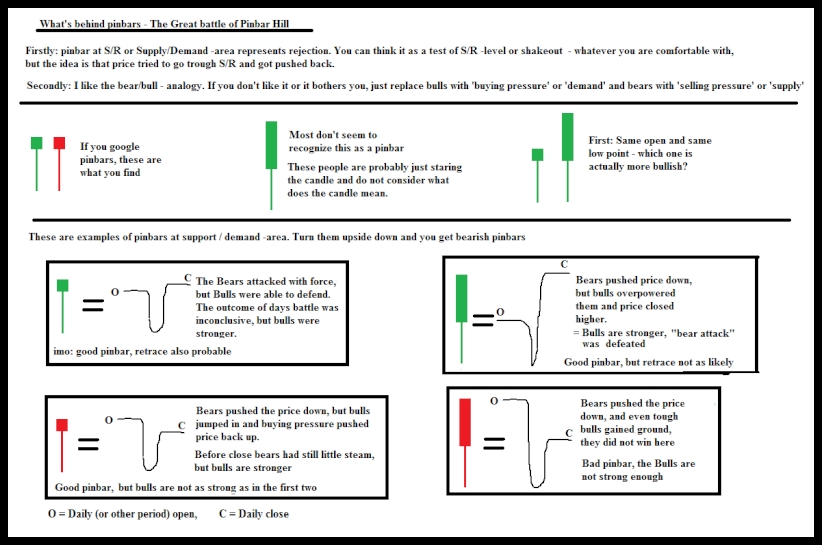

Is that a strategy like pin bar strategy is not enough to make profits in the intraday trading.? Ofcourse we need MM, RM too. But a simple strategy like single candle pin bar (hangin man/ shooting star) is not enough to make consistent trades and wins as this pin bar setup often happens everyday in stocks and nifty too. Is there a need for advanced/complex/multi-indicator strategies?

Hi Although this is addressed to ST, I would like to add up my points. Multi-indicators is not needed, but it is better to have atleast two strategies one to trade in trending days and another to trade in trading days.

hanging man and shooting start are trend reversal signals or you can use them to short when price goes against HTF trend, that is we can short 5 min uptrend when shooting star is formed at resistance when 30 min chart is in down trend.

pin bars are always good entry points if you have the ability to enter by fine tuning entries with lower time frame, if not they mediocre risk:reward ration only.

Advanced strategies are never needed to make money consistently from the market but Advanced understanding of the market is a necessity with which you can construct a simple framework and set of rules that can be used as a strategy to trade the markets and live of the money made from trading the markets. All the best in your journey for reaching the stage of consistently profitable.