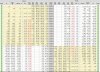

Sold 30900 CE and 30700 PE at 47 appx. combined premium 95

qty: 1 lot each.

mohan.sic said:

Booked profit in 30900 CE @ 26 and Shorted 30800 CE @ 54

Added another short 30800 CE@ 53

Booked profit in 30800 1 lot @35 and Shorted 30700 ce @ 75

qty: 1 lot each.

mohan.sic said:

Booked profit in 30900 CE @ 26 and Shorted 30800 CE @ 54

Added another short 30800 CE@ 53

Booked profit in 30800 1 lot @35 and Shorted 30700 ce @ 75

Did not short anymore options and I covered above CE short in Loss.

Got completely engaged in scalping ( buy side) and could not update anything later. Overall its a good day.