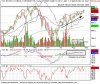

Incase of Exide probably not yet. Infact I wanted to ask what would you do now. Options would be

Book profit at Entry price + 6*ATR on the 14th day of entry @ Rs 380

Have a trailings stop at 0.5 ATR from tomorrow = C-7.5 =356

or continue with the Chandilier stop Loss which is at 329.

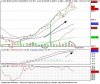

Where as Rain Commodities has penetrated the BBT and has closed below the Band with an Engulfing Bearish Candle. Also has hit Rs 151 which is Entry price + 6 * ATR of 14th. giving a profit of 28%. Isn't it time to take profit.

Appreciate your Views

Thanks

ken

Book profit at Entry price + 6*ATR on the 14th day of entry @ Rs 380

Have a trailings stop at 0.5 ATR from tomorrow = C-7.5 =356

or continue with the Chandilier stop Loss which is at 329.

Where as Rain Commodities has penetrated the BBT and has closed below the Band with an Engulfing Bearish Candle. Also has hit Rs 151 which is Entry price + 6 * ATR of 14th. giving a profit of 28%. Isn't it time to take profit.

Appreciate your Views

Thanks

ken

1. Take half after 1 * ATR is reached and set the stop to break even. If you adopt this method, when a stock makes a high bar, continue to take % of shares for profit. This is the reverse of buying in small lots.

2. After 1 * ATR is reached, continue to trail the stop to 2 * ATR to capture profits. Here you are not taking partial. You are holding on to 100% of the position.

Ofcourse, there are variations to this. You can rate your profit trade based on 1 * ATR - C, 2 * ATR - B, 3 * ATR - A. If 3 * ATR is reached, you can completly take out the position since you have attained A rating for your trade.

3. And there may be other way to do it based on your objectives.

Before I used to follow Option 1. Recently, I changed to Option 2. Whatever option you choose, stick with it. Do not chose option 1 for a trade and use option 2 for another trade. If you are using Option 1, then you should have taken profit for ExideInd.

Stock Tips:

I did not run through the scan due to boring index action. I am just looking at some stocks I am following. Look at CLASSIC for entry. Refer to previous post.

Last edited: