Enter with a buy stop ...

Use limit orders. Wait for it cross the price and place strictly limit orders.

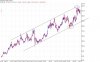

Wipro@520

For last 6 months its been trending. The trend line is still in tact. Just that it has pull back into short term trading range between 487 and 533. At this point, I would put a stop below the base at 485. Look at the chart.

reliance communications@309

I can't read anything from the chart. I use TA. So, less data doesn't help me. You might have bought basing on Fundamental analysis. Did anything change in your plan.

satyam@390

The current price is 836. Are you asking me what to do? Whatever!!

tata motors@444

Same as above. U are in good position. Take partial profits and trail the stop below previous base. Give some room for the stock as U are already in profits. As it goes up, we go up.

canara bank@190

You bought it at right point, at the bottom of the parallel trend lines. Your objective should be to take profits at the top of the trend lines. This is a different pattern. Look at the chart.

Also, can u pls explain 50 day EMA.

I am not going to go thru the technicals (there is so much info on the net). Just realize the importance of 50 day EMA. It is the heart beat of a stock (ofcourse, people use 200 day EMA also). But, once a stock moves below 50 day EMA, try to avoid going long. Now people will argue that it may come back etc etc. What I am just saying is that the probability of a stock below 50 day ema going up is less than a stock which is above 50 day ema. So, I rather bet my money on something which is above 50 day ema. So, in real time, 50 day EMA is used for filtering stocks as well as a buy point for people who like the fundamentals of the stock.

---Could you please give your analysis about RCVL, Reliance Communications Ventures. I entered into this stock at 298 and then averaged it to 293.

It going up and then coming. Do you think its good to accumulate now or wait for some more time. And what do you think the impact of results will be on this.

Look above. I am not an expert on IPOs. I have to pass on. Having no data doesn't help me. When you buy IPO, believe in the company. Make decisions, based on changes in the fundaments of the company. About averaging, don't add to a losing position. Wait till you make money on the stock. When it goes up and then pulls back, thats when you want to add. Try to add only 50% or 25% of existing position. Don't make existing profitable position a losing one.

MORAREALTY touched 686 today and closed 655.

---Is it a pull back?

No. Its just noise. Remember this is real time. Its no text book where you see clean charts, because they knowingly pick it for you for clarity.

---Can we enter here?

No. There is no setup now. If you are already in it, thats fine.

what will be stop loss? No setup.

---also Tvs motors.

Is it time to enter?

The stock has too much volatility right now. The stop loss has to be far. So, avoid for now. May be its a new pattern. Let it settle down.

---Some times price shoots up with that kind of spike in volume and another time price go down sharply.Yet another time no big movement

As I said earlier, this is real time. There will be noise. The volatility is caused due to several reasons.

1. Some news has come out and public is reacting.

2. Volume of stock is less. People can play the stock.

3. Short squeeze. The stock has been shorted a lot. When it gets buying a lot, people are getting stopped out or get a margin call and cover orders rushin.

4. Value of the stock. Higher the value, more volatile the stock is.

There might be several other reasons. Try to avoid low volume stocks. You can avoid stocks based on their existing pattern. If you really like something inspite of its volatility, use stop loss, taking into consideration its movement.