Low Risk Options Trading Strategy - Option Spreads

- Thread starter AW10

- Start date

- Status

- Not open for further replies.

Thank you Dan for the detailed and clear explanation. !!!

:thumb::thumb:

:thumb::thumb:

Try to establish some rules for the markets you trade, when to implement a ratio put spread or a ratio call spread or when to implement a put ratio back spread or a call ratio back spread.

Be very careful with this strategies. If you now already are confused, it shows,that you are not familiar with this different kind of option strategies.

In the beginning, I lost a lot of money because of that confusion. So better start to understand the different between this strategies and if you start to understand the different between them, you will enjoy to trade them.

If you understand them, they are low risk option strategies. If you not understand them, they are like bombs and they will blow away your money in a way, you thought : This is not possible.

DanPickUp

Dear Options expert pl help:

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot

SELL JUN 5700CE 2lots

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot

SELL JUN 5700CE 2lots

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

IV will certainly impact the pricing. The impact will depend on level of ATM/OTM from current spot level and the volatility at that time.

coming to calculation - say 5400 CE was at 113 and 5700 CE was at 20.

Net debit to open the strategy = 113 - 2*20 = 73. For one contract = 73*50 = 3650.

Minimum Breakeven to see any profit on it, 5400+73 = 5473.

Below this level is only loss, which is limited to max of net debit = 3650

Max profit, expiry at 5700 when sold calls are worth 0, and bought call has max value. The profit will be = (5700-5400-73)*50 = 11350.

You can also calculate the value of position when spot is above 5700. To understand it easily, break it as 1 5400-5700 call spread + 1 naked 5700 short call. Max value of call spread can be 300 giving max profit of 227. Above 5700 when second short position starts loosing, you have the buffer of profit earned on spread to protect till nifty reaches 5700+227 = 5927. Beyond then it is at the mercy of market.

My sincere suggestion - you have been good tv viewer and listened to the partial truth from expert. Now become good trader and evaluate it. Believe in your method of analysis cause other people might give approximate numbers.

All the best and happy trading

Hi AW10

I am only the cleaner of the road in front of you, when it comes to the Indian market. As you know me, I do my job as best as I can. All the rest stays not on the discussion table,as we trade completely different markets with completely other tools and possibility s.

Never mind about that . I have learned a lot in this forum about future trading and I really have to say : Thank you to all of you about that

. I have learned a lot in this forum about future trading and I really have to say : Thank you to all of you about that

My option trading may is very unique and so it is. What did I read in this forum : Be your self and start to trade your own way. So I do

Regarding to any TV show : :rofl::rofl::rofl:

Just forget it.

Never trade on such infos as long as you not see behind the reasons, why the trade is recommended. If you follow this rule, you never again will fall in that trap.

Why now / What risk is included / are tow simple questions to ask, why you should believe the guy in the SHOW. Never ever forget :

http://www.youtube.com/watch?v=4ADh8Fs3YdU

Take care

DanPickUp

I am only the cleaner of the road in front of you, when it comes to the Indian market. As you know me, I do my job as best as I can. All the rest stays not on the discussion table,as we trade completely different markets with completely other tools and possibility s.

Never mind about that

My option trading may is very unique and so it is. What did I read in this forum : Be your self and start to trade your own way. So I do

Regarding to any TV show : :rofl::rofl::rofl:

Just forget it.

Never trade on such infos as long as you not see behind the reasons, why the trade is recommended. If you follow this rule, you never again will fall in that trap.

Why now / What risk is included / are tow simple questions to ask, why you should believe the guy in the SHOW. Never ever forget :

http://www.youtube.com/watch?v=4ADh8Fs3YdU

Take care

DanPickUp

Dear Options expert pl help:

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot AT 122

SELL JUN 5700CE 2lots AT 25.7

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot AT 122

SELL JUN 5700CE 2lots AT 25.7

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

ce 5400 122 and ce 5700 25.7

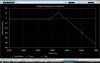

This strategy is ratio spread with limited risk on dowside but unlimited risk on upside. Your maximum loss on downside will be 3530 and the maximum loss on upside will be unlimited. ( 1 or 2 points may differ) Your breakeven on dowside will be around 5470 and on upperside 5930 . Your maximum profit will be 11470 if it closes exactly at 5700. There is unlimited risk above 5929 as you are holding only one ce lot and you have sold 2 ce lots. The profit will be as if nifty closes on expiry at 5500= 1470 , 5600 =6470 5700 11470, 5800= 6470 , 5900 = 1470 and above 5929 risk is unlimited

Last edited:

Dear Options expert pl help:

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot

SELL JUN 5700CE 2lots

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

In today's TV show "vayde se fayda" one expert suggested the following strategy

BUY JUN 5400CE 1lot

SELL JUN 5700CE 2lots

max loss Rs.3600

profit Rs.11800

Obviously the strategy is ratio spread. But, in Option oracle iam unable to come up with the max loss part or profit part.

a) Could you please elaborate how these numbers were arrived at?

b) Could i initiate a put ratio spread like this and create a band for nifty? i.e

BUY JUN 5300PE 1 lot

SELL JUN 5000PE 2 lots.

c) is this strategy IV dependent? meaning will rise/fall in IV affect performance?

d) the profit target is 100/200 points from long strike....so how does this look?

thank you for your time.

If you buy one pe and sell two pe , here the loss is limited on upside but loss is unlimited on downside. If market crashes , you will suffer huge loss.

So first try understand and assume the various scenario , if any thing unexpected happen , say 500/1000 movement on dowside happen . It is not rare that 500/600 points of movement is not possible in short period. it has happened many times in the past. So be careful while initiating on such unlimited risk strategies till you understand the option strategies properly

Last edited:

Hi comm4300

The first example you give here is a "Ratio Call Spread". A few facts to this strategy :

Direction : Slightly bearish / Risk : Uncapped / Max. Reward : Capped / Volatility : Low

Calculation : Long call you have to give money from your pocket and short calls you get money in your pocket. Idea behind that : Only little money should be on the risk floor from your side with this strategy.

Danger with such trades : Wrong direction choose d and volatility increases immense.

If you have a ratio call spread and market moves up, your short calls are going to kick you in your face. On the other side, if you not get enough money to pay for your long call, you are under the zero line on the left side in your risk picture.

That means, that market has to stay in an exact range that you not get hurt. On the downside, your risk is fixed. If market falls under 5400, you only can lose a fixed amount of money. If market moves up ( over 5700), your risk is unlimited. If market at expiration stays some where in between, you make profit.

With other words : The guy in the show did not get enough money with the sold calls to pay his long call. So he can loose 3600 Rupee, in case the market moves under 5400 or where ever his exact break even in his calculation is on the downside.

Now he makes the people hot by telling them, that they can make a profit of 11'800 Rupee. If he can make this money, he only can make it, when market at expiration is in the middle of his range.

But what he not says : If market moves further up, people start to get in danger with unlimited risk of loss, in case the 5700 or upper break even is broken. People should know that, even it is not very likely at the moment. But how knows so exactly ?

The second strategy you show is a "Ratio Put Spread". It is traded in slightly bullish market with low volatility. Unlimited risk on the downside and limited risk on the upper side. If market closes in the middle of the range, biggest profit.

Hope it helps and have a nice evening

DanPickUp

The first example you give here is a "Ratio Call Spread". A few facts to this strategy :

Direction : Slightly bearish / Risk : Uncapped / Max. Reward : Capped / Volatility : Low

Calculation : Long call you have to give money from your pocket and short calls you get money in your pocket. Idea behind that : Only little money should be on the risk floor from your side with this strategy.

Danger with such trades : Wrong direction choose d and volatility increases immense.

If you have a ratio call spread and market moves up, your short calls are going to kick you in your face. On the other side, if you not get enough money to pay for your long call, you are under the zero line on the left side in your risk picture.

That means, that market has to stay in an exact range that you not get hurt. On the downside, your risk is fixed. If market falls under 5400, you only can lose a fixed amount of money. If market moves up ( over 5700), your risk is unlimited. If market at expiration stays some where in between, you make profit.

With other words : The guy in the show did not get enough money with the sold calls to pay his long call. So he can loose 3600 Rupee, in case the market moves under 5400 or where ever his exact break even in his calculation is on the downside.

Now he makes the people hot by telling them, that they can make a profit of 11'800 Rupee. If he can make this money, he only can make it, when market at expiration is in the middle of his range.

But what he not says : If market moves further up, people start to get in danger with unlimited risk of loss, in case the 5700 or upper break even is broken. People should know that, even it is not very likely at the moment. But how knows so exactly ?

The second strategy you show is a "Ratio Put Spread". It is traded in slightly bullish market with low volatility. Unlimited risk on the downside and limited risk on the upper side. If market closes in the middle of the range, biggest profit.

Hope it helps and have a nice evening

DanPickUp

The breakeven is 5929. There will be no risk if nifty closes at or below 5929 on expiry day . There will be unlimited risk only if nifty closes above 5929 on expiry day. Upper breakeven is 5929.

Thank you, that you checked it on your matrix. That is the only way to trade options. All other kind of guessing or what so ever is just some kind of gambling.

Thank you to check it, as I do not make any trades in your market. But the system is the same all over : You can create strategies on your matrix and you can check strategies on your matrix. You may not have to many tools and you should use the ones you have to the most extended point you can do.

We create new strategies built on the ones, which already exist. That is what I meant with the comments : Work it out by your self on the matrix.

The chart is one part in option trading and the other part is the matrix. We check the chart and then we start to work out the strategy on the matrix.

DanPickUp

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| O | Take low risk, earn low profit | Forex | 0 | |

| R | How do you follow risk management strategy? | General Trading & Investing Chat | 4 | |

| O | How do you lower your trading risk? | Forex | 9 | |

| J | Low Risk Nifty Options Strategy (Risk < Rs.1500) | Options | 3 | |

| P | Low Risk Options Trading Strategy | Options | 7 |

Similar threads

-

-

How do you follow risk management strategy?

- Started by ReggieFx

- Replies: 4

-

-

-