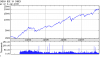

Markets in BUBBLE ZONE?

- Thread starter rajeshn2007

- Start date

Similar threads

-

fundamental analysis to forecast forex markets

- Started by ReggieFx

- Replies: 1

-

-

-

-

Putting the Power of Confluence to Work for Trading Markets- Part2

- Started by Forextamil

- Replies: 0