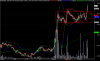

Good find @ RAYMOND

Watch the similarity between RAYMOND and SCI.

Notice the similar "corrective" structure before the first 'Impulse" its a good sign, add that to the following factors :

1. Two wave corrections followed [zig-zags, flats etc] which is usually far as wave 2 goes [except in much larger patterns]

2. The lower trendline had three hits - 2 is good, 3 is better.

3. The third should happen on / around / very very close to the 61.8% retracement [SCI came down to test it one more time = jitters, but not uncommon]

4. The parallel line from the base, shifted to the top (to the HIGH price of the top of the first or the CLOSE price of the top of the first ? dunno

), works as support [see SCI]

5. One EOD CLOSE above the upper trendline is usually the confirmation people look for [Watch the GAP that happend on both stocks the day after the EOD closure above the upper trendline]

6. Ive draw FIBs from CLOSE price to CLOSE price, but most ppl use LOW and HIGH prices, its a matter of choice, but unless you have reason to do otherwise, i would suggest using HIGH / LOW prices.