I am concentrating these days in Technical analysis.Previously I was thinking

TA are lagging in nature so I did not spend time on it.Nowadays I realised TA is also a necessary aid for trading.In this year I am learning in full swing so please help me.

I believe in more of CA (Chart Analysis) than TA (Technical Analysis)...

(i m not sure whether CA & TA can be called as same, or one is a subset of the other)

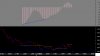

CA requires proper study & analysis of price movement (some prefer with volume too) & various chart patterns breakouts...

For me, CA can never be lagging, as price never lies. If today 2800 gave good support, it was because on its last retest, it had given very good support too & led to a rally till 3150.

But, if on Monday, it is again subject to test quickly at open, I doubt whether it would be able to hold... At best. 2790.

Saint sir's flow method uses only CA (price bar analysis)... you go short at reversal pivot bar's low's break; you go long at break of reversal pivot bar's high.

With CA, one can time his entry level & also his stop loss & target levels.

KNOW THY CHART, KNOW THY TREND, KNOW THY STOP & THUS, KNOW THY ENTRY....

TA, for me, involves technical tools like Moving averages, RSI, MACD, TRIN, slow stochastics, etc... ALL of them are lagging in nature... THERE'S NO ARGUMENT ABOUT THAT....

you cannot say for sure that as soon as RSI touches 30, one should go long WITHOUT EVEN HAVING A LOOK AT CURRENT PRICE LEVEL...

That's why, we have to wait for "cheats" / "tricks" like divergences, crossovers, etc...

Even I don't completely rely on RSI alone, unless there's known chartical RSR level nearby...

Today, for instance, at 2805 fut level when I went long, after few moments, I spotted bullish divergence in RSI chart (1min timframe).... That gave me more confidence of hitting atleast 2850, where I offloaded half of my qty.

But, the initial & bigger confidence came from knowing the value/importance of 2800, and not RSI (1min) = 30!!!

DEVOTE MORE TIME TO PRICE MOVEMENT & CHART PATTERN ANALYSIS.... rather than knowing the nitty-gritties of technical indicators, their formulae, etc...

This is my personal view & may differ with others...(though I don't know anyone who swears ONLY BY technical indicators)