OK Here it goes with the VOLT Chart...

One more important indicator to watch out - VOLT Trendline Chart

I am not expert still in the VOLT Trendline charts. but I have been observing the charts. I have included in the OAT tool so that we can learn and make some useful interpretations.

How to Read the VOLT Trend line Charts?

There are threee lines

Green Line - Green line on TOP indicates Bullish

Red Line - Red Line on Top indicates Bearish

White Line - Overall Trend line - This is what is most important and we have to analyse the patterns.

Look at where the Red Line and the Green line meet - That is the Reversal point Or the Breakout point

Some of the obvious patterns you can remember for the White lines

A pattern in the form of a Tick mark and the Green line is above the Red line - Extremely bullish pattern - So the traders are willing to buy the Options at higher premium

Reverse (Mirror image) of a Tick mark - Bearish Trend - Traders are betting more on the downside and so the VOLT will be high on the Downside strikes.

so with the above knowledge - Let us look at some of the Key indices and stocks

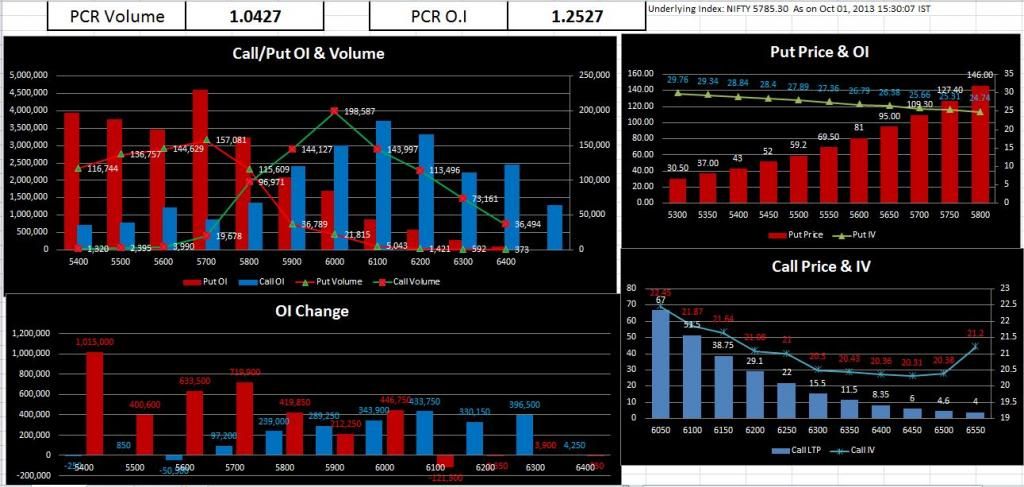

NIFTY - Meeting point is 5650. So more downside is left. For the time being it is a SELL on HIGH because the Trend line is a Diagonal line. No sign of Bullishness till 6000

Raj

Could you explain the volatality chart information I have been trying to observe from the last few days.. .at instant it shows as below

Does this indicate that downside still exists till 5750? as Green and Red lines intersect at that point?