Some Good Steals...

- Thread starter AMITBE

- Start date

- Status

- Not open for further replies.

Re: Some Good Steals... (KEC)

See the bulk transactions on this counter

KEC International 3.29 lac shares Tata Mutual Fund

KEC International 3.60 lac shares Reliance Capital Trustee

rakamath said:

dear garun 1979, I checked the bse site. there is no stock split, but there is some Scheme of Arrangement between the Company and Bespoke Finvest Ltd and KEC Infrastructures Ltd (Operation Co.) and KEC Holdings Ltd (Invest Co.) and their respective shareholders.

can anyone throw some more light on this, because the announcements on bseindia are not very clear.

can anyone throw some more light on this, because the announcements on bseindia are not very clear.

KEC International 3.29 lac shares Tata Mutual Fund

KEC International 3.60 lac shares Reliance Capital Trustee

AMITBE said:

Hi Partha...

On the face if it, yes, there is a descending triangle on the daily chart where several lows are occurring at a consistant price level, with highs moving lower still.

So as you must be aware, a triangle pattern can be a continuation pattern or reversal pattern too............Regards.

On the face if it, yes, there is a descending triangle on the daily chart where several lows are occurring at a consistant price level, with highs moving lower still.

So as you must be aware, a triangle pattern can be a continuation pattern or reversal pattern too............Regards.

Fully agree with pankaj.......a must visit thread..

regards

Re: Aksh Optifibre

Hi Partha...thanks for those kind words, but there is nothing here that you cannot do with practice. On the other hand I'm sure there is much here that has missed my eye too. The more one learns the finer it gets, which is true of any field.

I'm enclosing a detail from my daily chart here with trend-lines, and the arrow A pointing to the lone down bar in recent times which closes at 69.10. Going further back would show a few supports at 66-65 and then lower still. Those are from the time when the trend was on the rise, and perhaps in a down trend may not hold too well. For this reason below 69 is taken as stop, keeping in mind your entry.

To the up, the wide range bar pointed to by the arrow B shows closing price at 78. So this the price that needs taking out. On the subject of these gap bars, they extend much higher or lower than surrounding price bars, and usually reflect extreme sentiment and can be followed by reversals or consolidations. How and where a sharp spike occurs is something to note. In a trading range, a spike may just be a temporary 'noise' but if a spike occurs after an ongoing trend, it can be a sign of a price exhaustion. Arrow C is an example of this.

Also note that following the bar at arrow A, the next bar too is a wide bar where the price has jumped back up to 76 from 69 with increased volume. Following this the price has generally drifted along well above 69 but well below 78, seeming to suggest the buyers are not yet willing to go higher and sellers willing to go lower.

So, it's a wait and watch...and the longer the price drifts, the further it gets from a 'reversal' angle. This is subject to the markets holding of course.

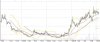

On to another interesting observation, this time on the weekly chart (2nd chart). There is a clear case of a cup&handle taking place here.

This is a pattern on a bar chart that is usually seen forming over a long period of time. The cup is in a U shape, with the handle having a slight downward bias. The right side of the pattern has low volume. As the price comes up to test the old high, the stock would have selling pressure by those who bought in near the old high. This will make the price trade sideways with a downwards bias for a period of time. At some point the breakout would happen, typically to the up.

So keep a watch and all the best.

p_haolader said:

Hi Amit,

Thanks for the reply. Great analysis and lot's of insight. Never had an idea that a chart can tell so many things. Hats off to you and the members of this forum.

Happy investings

-Partha

PS : Did you use the screenshot I provided or u use some other s/w. In that case can you please upload a screenshot with the trendlines and how u arrived at the stop loss.

Thanks for the reply. Great analysis and lot's of insight. Never had an idea that a chart can tell so many things. Hats off to you and the members of this forum.

Happy investings

-Partha

PS : Did you use the screenshot I provided or u use some other s/w. In that case can you please upload a screenshot with the trendlines and how u arrived at the stop loss.

I'm enclosing a detail from my daily chart here with trend-lines, and the arrow A pointing to the lone down bar in recent times which closes at 69.10. Going further back would show a few supports at 66-65 and then lower still. Those are from the time when the trend was on the rise, and perhaps in a down trend may not hold too well. For this reason below 69 is taken as stop, keeping in mind your entry.

To the up, the wide range bar pointed to by the arrow B shows closing price at 78. So this the price that needs taking out. On the subject of these gap bars, they extend much higher or lower than surrounding price bars, and usually reflect extreme sentiment and can be followed by reversals or consolidations. How and where a sharp spike occurs is something to note. In a trading range, a spike may just be a temporary 'noise' but if a spike occurs after an ongoing trend, it can be a sign of a price exhaustion. Arrow C is an example of this.

Also note that following the bar at arrow A, the next bar too is a wide bar where the price has jumped back up to 76 from 69 with increased volume. Following this the price has generally drifted along well above 69 but well below 78, seeming to suggest the buyers are not yet willing to go higher and sellers willing to go lower.

So, it's a wait and watch...and the longer the price drifts, the further it gets from a 'reversal' angle. This is subject to the markets holding of course.

On to another interesting observation, this time on the weekly chart (2nd chart). There is a clear case of a cup&handle taking place here.

This is a pattern on a bar chart that is usually seen forming over a long period of time. The cup is in a U shape, with the handle having a slight downward bias. The right side of the pattern has low volume. As the price comes up to test the old high, the stock would have selling pressure by those who bought in near the old high. This will make the price trade sideways with a downwards bias for a period of time. At some point the breakout would happen, typically to the up.

So keep a watch and all the best.

Attachments

-

47 KB Views: 32

-

45.7 KB Views: 22

roneeth said:

Hello Amit,

Thanks for your prompt response.I am still in and the intaday high was 289.I could see that accumulation was going on around 267 level but was not sure.

If time permits i have one doubt,yesterday the close of greaves was 261.If i had kept a stop at 265.Where should i have exited ideally?

Till now i had taken all my stops intraday.

1.Exit at 265 intraday that would have been yesterday.

2.or Today morning as it dipped after open again 256 was todays low till now.

i am a little confused about this.

Thanks and regards

Roneeth

Thanks for your prompt response.I am still in and the intaday high was 289.I could see that accumulation was going on around 267 level but was not sure.

If time permits i have one doubt,yesterday the close of greaves was 261.If i had kept a stop at 265.Where should i have exited ideally?

Till now i had taken all my stops intraday.

1.Exit at 265 intraday that would have been yesterday.

2.or Today morning as it dipped after open again 256 was todays low till now.

i am a little confused about this.

Thanks and regards

Roneeth

On Cummins, the assumption was that it had shot up almost 60-70% in very few sessions, and the risk of a quick slide was quite real. At current levels the wider market too has been very difficult to call. So the exit was quite proper as far as that goes. Once it was touching 212, it never breached 201 to the down, thanks largely to buying interest from strong hands that had apparently moved in and didn't get shaken out.

On the plus side, we now know exactly where Cummins would head to following a sharp currection that has to happen sooner than later. So we'll have our go again I'm certain.

To your question, I normally don't practice stopping out during intraday price action even if an important support gets taken out, as very often it's seen in a good trending move that the price usually moves back above that trigger. I wait for the next day to observe price/volume action to take the decision. This is of course not the case when a stop level is firmly broken with increasing volume.

If you use a trading software you will see the total bought and sold quantities reflect the sentiment. In the s/w I use, these figures reflect the number of orders pending at various price levels on both sides. Where the pending buy orders are bigger than sell orders, it's a good indication that there would be good support lower and the price would get back up.

At the end of the day, trading closely by the rule book is something I don't prefer to do as there can be so many variables involved.

A rule-book kind of a trader is defensive and disciplined and it's a good way to be I guess, but it can get mechanical where ready wits can often result in better choices.

So you did well in making a good judgement of the trade in GC, and there is something to be said about trading in strong counters like these especially at the price it's trading at.

Do be watchful on it as the air has still not been cleared yet. Crompton Greaves did well too yesterday and this may have reflected on this one too.

All the best.

nkpanjiyar said:

Great call on Bharat Forge Amit. Missed it . Can i enter now?

. Can i enter now?

cheers,

nkpanjiyar

cheers,

nkpanjiyar

In case you wish to buy in, accumulate at declines. Though in a falling market the following levels may provide a decent entry: 403-400-397-394-390-385.

A close above 416-419 would push it towards 435, and a close above 440 would add another 50 plus points...subject to how the markets pan out of course.

If and when you do get in, call back if you like for stops etc. As I had mentioned in the earlier post, a counter like this has minimum downside risk, and is one of the blue-chips in the making if not already there.

Post April-May annual results, a lot of the recent major investments would begin to reflect in the price action I believe. It's a wealth creator in the long term.

All the best.

karthikmarar said:

A classical example of great chart study...and.. how much information a chart can throw up... Excellant, Amit.

Fully agree with pankaj.......a must visit thread..

regards

Fully agree with pankaj.......a must visit thread..

regards

There's ways to go still and it's a fun journey too.

Thanks very much, Karthik.

madhura said:

hello,

I want to speak about aftek infosys..the stock dipped to 95. this is near to support level for stock. Also results are more than last quarter. This would be decent entry in the stock? what say?

i am planning to enter the stock. please guide.

I want to speak about aftek infosys..the stock dipped to 95. this is near to support level for stock. Also results are more than last quarter. This would be decent entry in the stock? what say?

i am planning to enter the stock. please guide.

Aftek was doing well till quite recently and now this sharp downwards move. At 95-96 it's trading at a critical support. There is nothing on the tecnicals to suggest a buy, even if this level holds and becomes a base support or even if it's quite oversold.

Moving above 102-108 with good momentum and volume would make it attractive with a stop at current levels.

If you want in for the mid to long term, it's a pretty good counter then at these levels with a stop at 82.

Regards.

sanjoy_roy said:

Hi Amit,

I would love to be wrong on this one 'coz still in the learning curve.

The supports for Aksh exists at 69, 62, 55, 42.

Regards,

Sanjoy

I would love to be wrong on this one 'coz still in the learning curve.

The supports for Aksh exists at 69, 62, 55, 42.

Regards,

Sanjoy

Yes, those are all support levels for Aksh, but in this context we were discussing the s/l levels for Partha considering his entry.

Keep up the study and all the best.

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| F | Do you know that HDFCBANK,ICICIBANK OR ANY HI FI BANK LITERALLY STEALS YOUR MONEY | Loans | 4 |

Similar threads

-

Do you know that HDFCBANK,ICICIBANK OR ANY HI FI BANK LITERALLY STEALS YOUR MONEY

- Started by ford7k

- Replies: 4