Hi Partha...this has taken long coming, but it's here now.

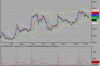

For Bollinger Bands, I use the middle line as a 20 day simple moving average, and for the outer bands, a standard deviation of plus and minus 2.

The moving average line smoothens out the price action.

The upper and lower bands envelope the price line to measure the volatility of the price line and to compare volatility and the relative price.

Almost all the price action is encompassed within the bands as they quickly adjust to price action.

Periods of sharp pikes or dips widen the bands to depict volatility, and when volatility drops to a minimum, the bands shrink together to give rise to the phenomena known as Bollinger squeeze.

MACD, Moving Average Convergence Divergence, is a trend following indicator that signals trend changes and also to indicate trend direction. Signals are generated by crossovers and divergence from price.

Assuming you have the technical knowhow of this indiacator, the direction of the long-term trend is the first assessment you would make of any stock. If it's up you go long, if down, go short. It should only be used to trade trends and never in a ranging market where it can mislead.

MACD as a trend following indicator would not show the early signs of a move, but would keep you on the side of the trend. Where a significant move develops, it would often help catch a big portion of it. When the trend is short, MACD can lead one into a whipsaw.

You have done well to spot the positive divergence, yes it is there.

The chart with me shows a mid term correction/consolidatin since mid July to September when the price tested 52 levels and fell back each time. A corrective move like this nomally occurs when a rigid resistance doesn't get taken out...as in a double or triple top. Also the arrow points to a long range bar, 'Price Exhaustion' that opens 55 off, low at 50, close 51.50, meaning very close to the day's low. The trend is about to change here.

Following this the price declines sharply to test the low at 38 end October, rises to 48 early December, and then falls to 35 end December to rise to 43 early January. Then it drops to 36 off, making a marginally higher low, and stablising there for a period of sideways consolidation.

So we have lower lows and lower highs, a typical formation of a mid term down-trend consolidation, as each low at 38 and 35 is not radically far from the other. Relatively, selling pressure was stronger at higher levels with the buyers unsure and not coming in. Buying came in relatively early at the lower levels.

Your MACD signal is quite true where the crossover corresponds with a price move to the up after the consolidation and test of support at 36-37.

The resultant high at 45 on Feb 13 takes out the previous high at 43. The next day it slips again to take support at 43, a previous high resistance, now supporting. The next day up again then down the next, in the same band.

This is a whipsaw goin on here as the price attempts a breakout. The reason: Check the volume bars. It's thinning out even more. This is a sure giveaway, suggesting a no go yet. Simultaniously, another important inference to be drawn from this is, in the falling price, the volume thins out, and so, the sellers are not increasing in numbers even if the buyers are not coming in. As the selling pressure is not intense, there is a stand off, and the matters are even-stevens.

One critically important aspect of MACD crossover is the location of the crossover in relation to the zero line and is illustrative of how strong a trend might be. A crossover above the zero line is considered more bullish than one below the zero line. The higher above the zero line it crosses, the stronger the uptrend. If the crossover occurs below the zero line, the uptrend is not going to be very strong in most cases.

In the chart, note that the crossover is below the 0 line and so the uptrend is obviously floundering.

Associated with your Bollinger Bands theory here, there is in fact no clear evidence of a squeeze of late, as suggested by you. The bands have been flung quite apart, meaning the volatile correction/consolidation is still underway even if it appears that a bottom support has been formed.

So in conclusion, it's a wait and watch. An outbreak may or may not happen in the near term, but price stablity marked by a clear drop in volatility is much needed.

Hope this is helpful, and get back for clarifications if you like.

All the best with the journey in TA.

As you said:

To life.