Re: Paramount Communications

p_haolader said:

Hi Amit,

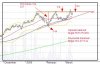

The chart for Paramount communications look interesting. Twice it has tried to break the 180 levels and failed. Now its trying a third time CMP 180.45 . Should it cross successfully i think it will fly. I have attached the chart , please have a look.

Now for my questions. If indeed PARACOM breaks the resistance then what will be the targets? Can you please provide a chart and explain how you arrived at the targets. Just in case PARACOM starts comming down, where should i place my stop loss.

Thanks a lot,

-Partha

Hi Partha, a nice chart you have recognised in Paramount.

Obviously there is an ascending triangle taking shape here.

As we have discussed in a previous post on ascending triangles, the breakout should come about 2/3 way down from the beginning of the wide end of the triangle going towards the apex where the two trendlines would eventually meet. Closer the action moves towards the apex, higher the probability that the price would just drift along.

For the duration of an ascending or descending triangle, the general consensus is that it would take from one to three months to form and achieve the breakout.

This triangle begins to form around mid Jan, and now is nearing the time rule zone for the breakout. The two arrows on the chart point at the 1/2 way mark and the 2/3 mark, roughly.

For caution on these triangles, they are quite susceptible to false or failed breakouts. Volume gets quite thin as the triangle/trendlines move towards the apex, a slightly sharp activity can bring about increased volatility driving the price outside the trendlines. Entry without proper volume/price confirmation can lead to a shakeout. It's best to wait for atleast the day's close to see if the price would close outside the breakout zone. Even so, a shakeout can happen a few days later too if there is increased whipsaw action.

For calculating price targets the simple rule of the thumb is as follows: Calculate the height of the triangle. This would be on the extreme right at the start of the triangle where the two trendlines are the widest apart. This is the line that joins the top trendline which is the even horizontal line, and the first bottom where the up-slanting second line starts. The first bottom is the deepest of course, so the maximum height is this.

In the chart, this height is 37. We arrive at this as follows: The deepest low is 144, and the top trendline defines the 181 level. So 181 minus 144 gives us 37.

Now, when the upside breakout occures, this would naturally happen above the 181 mark.

So, following the technical prescribed rule of the thumb, we add 37 to 181 and arrive at the figure of 218. This theoratically would be the target.

Instead if the breakout happens to the down, we minus 37 from 181 to arrive at the first target level of 144, which was the first deepest bottom to begin with, and the assumption would be that it would form the first support.

All of the above is theoratical of course and what happens on the market floor may vary, but it certainly provides a general guide.

Do take a check if you need to clarify anything.

Bye for now.