20-Jul-11 120.95 109.3 11.65

21-Jul-11 120.3 108.7 11.6

22-Jul-11 120.35 110.15 10.2

23-Jul-11 120.35 110.1 10.25

25-Jul-11 119.35 109.35 10

26-Jul-11 120.4 110.75 9.65

27-Jul-11 119.3 110.6 8.7

28-Jul-11 118.45 110.75 7.7

29-Jul-11 116.4 110.15 6.25

30-Jul-11 116.3 109.95 6.35

1-Aug-11 114.05 109.05 5

2-Aug-11 114 108.05 5.95

3-Aug-11 112.55 105.9 6.65

4-Aug-11 110.6 104.45 6.15

5-Aug-11 107.4 99.3 8.1

6-Aug-11 103.45 95.55 7.9

8-Aug-11 101 93.8 7.2

9-Aug-11 102.95 95.4 7.55

10-Aug-11 103.9 95.6 8.3

11-Aug-11 108.25 98.55 9.7

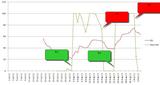

The spread trade has been magnificent since its high of 17 on 12/07. It dropped all the way to 5 on 01/08/2011 and then moved back up to 9.7 today. Only one or two whipsaws in the entire period.

The spread gap has moved 17 points. Trades on this spread should have realized between 10 - 14 points in the last four weeks.

21-Jul-11 120.3 108.7 11.6

22-Jul-11 120.35 110.15 10.2

23-Jul-11 120.35 110.1 10.25

25-Jul-11 119.35 109.35 10

26-Jul-11 120.4 110.75 9.65

27-Jul-11 119.3 110.6 8.7

28-Jul-11 118.45 110.75 7.7

29-Jul-11 116.4 110.15 6.25

30-Jul-11 116.3 109.95 6.35

1-Aug-11 114.05 109.05 5

2-Aug-11 114 108.05 5.95

3-Aug-11 112.55 105.9 6.65

4-Aug-11 110.6 104.45 6.15

5-Aug-11 107.4 99.3 8.1

6-Aug-11 103.45 95.55 7.9

8-Aug-11 101 93.8 7.2

9-Aug-11 102.95 95.4 7.55

10-Aug-11 103.9 95.6 8.3

11-Aug-11 108.25 98.55 9.7

The spread trade has been magnificent since its high of 17 on 12/07. It dropped all the way to 5 on 01/08/2011 and then moved back up to 9.7 today. Only one or two whipsaws in the entire period.

The spread gap has moved 17 points. Trades on this spread should have realized between 10 - 14 points in the last four weeks.