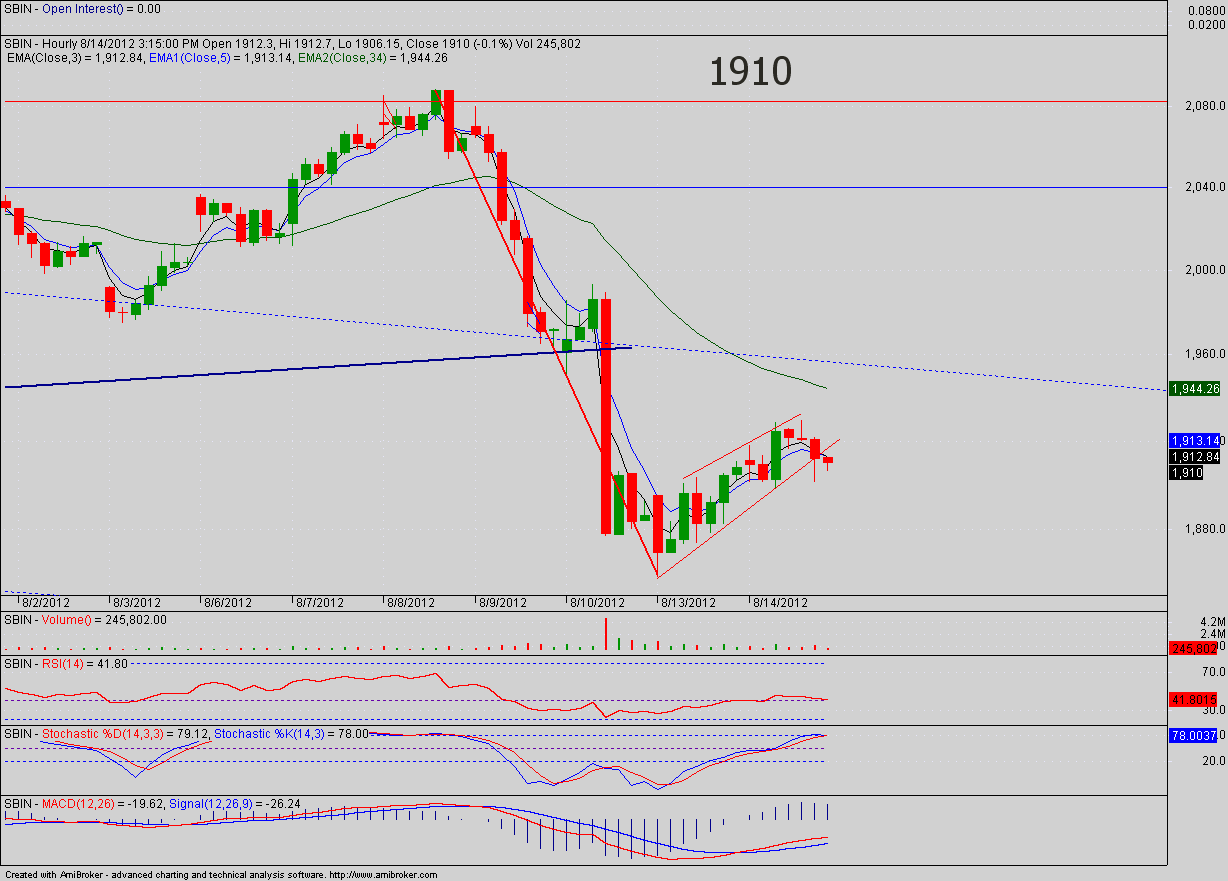

Guys In spite of all the bullish TA setups that we saw yesterday todays SBIN price action is telling something else.In spite the better than expected inflation numbers today's recovery was lethargic.

As I noted earlier there is a strong resistance at 1930 to 1940 range, though the price is currently very close to this range todays high came off the same range.

If the next two three daily candles gets rejected from this resistance range then that will be very bad sign and SBIN might take a fresh dive towards the south.(I don't know what could be the fundamental trigger)

In the other hand in case it is broken and then we may see slow and side wise recovery upto 2000.remember we have only 8/9 days left to expiry with 2 holidays.

What I am saying is the while the upside is capped but downside is uncapped for the time being.

Lets wait n watch