All bears are dead...... there is no such thing as the stock market going down.

There is freeee money everywhere and every dip is being viewed by buuulllllsssss as the buying opportunity of a lifetime.

The pic below is the Shanghai market, not a down day in the last 3 weeks. Also missing are the support points the market would have if direction changes suddenly.

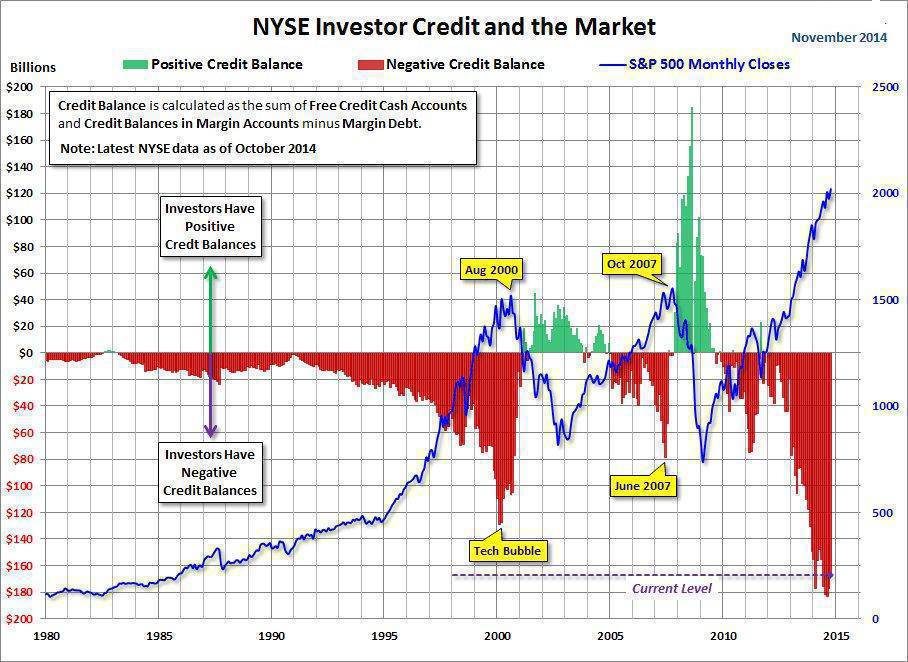

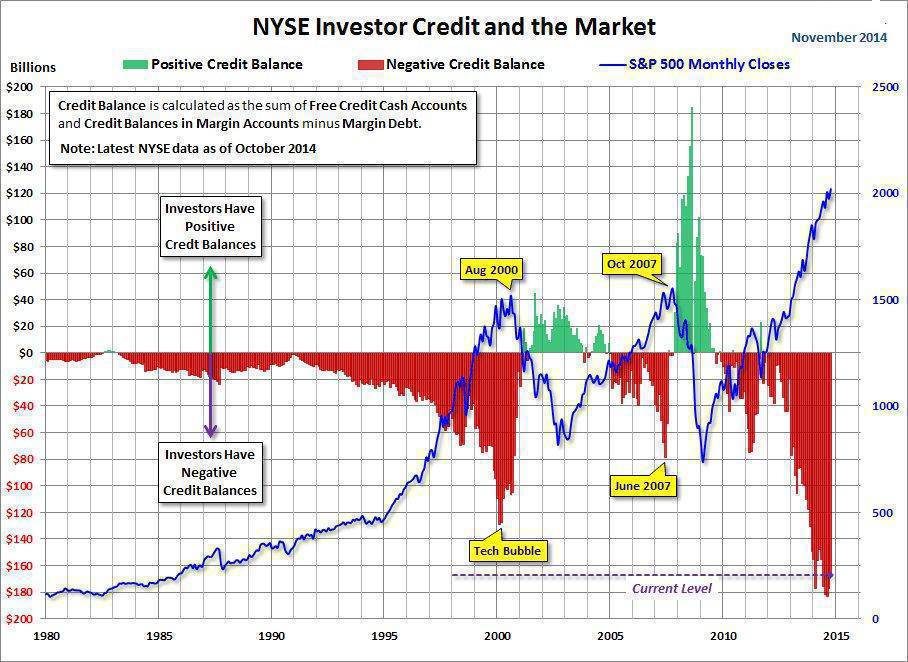

Another look at the US, Oppenheimer's John Stoltzfus: has a target of 2,311 for 2015

Crude oil prices could drip below $40 a barrel

http://articles.economictimes.india...913_1_crude-oil-prices-oil-boom-oil-exporters

Mcmillan thinks we are very close to a ..........

Stock-market correction imminent

http://www.marketwatch.com/story/correction-imminent-2014-12-02?siteid=yhoof2

A lot of stocks are very close to crunch point, a major move is in the pipeline.

There is freeee money everywhere and every dip is being viewed by buuulllllsssss as the buying opportunity of a lifetime.

The pic below is the Shanghai market, not a down day in the last 3 weeks. Also missing are the support points the market would have if direction changes suddenly.

Another look at the US, Oppenheimer's John Stoltzfus: has a target of 2,311 for 2015

Crude oil prices could drip below $40 a barrel

http://articles.economictimes.india...913_1_crude-oil-prices-oil-boom-oil-exporters

Oil's decline is proving to be the worst since the collapse of the financial system in 2008 and threatening to have the same global impact of falling prices three decades ago that led to the Mexican debt crisis and the end of the Soviet Union.

Stock-market correction imminent

http://www.marketwatch.com/story/correction-imminent-2014-12-02?siteid=yhoof2

A lot of stocks are very close to crunch point, a major move is in the pipeline.