Daily Nifty Analysis for 27 Sep 06

These are my personal musings. These are not in any way meant to be trading advise. To view the chart, check the link below.

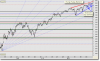

The purists among us will be extremely angry that the Nifty did not achieve the 3610 target. Does not matter. After all, the high was just 7 points away.

I am keeping a trailing stop of 3565 on the Nifty for long positions, as that coincides with two techniques. One is the 3568 intraday low, and the other is the rising trendline. Again people could question me saying that if I am so bullish on the market, then why keep such a tight stop?

Two reasons one is that my short term target is achieved, and the second is nothing prevents me from going long again at higher levels. For the present, my prime objective is to lock in my profits.

And take a new look at the Index, once this derivatives settlement is over tomorrow.

I am also marking out the stops which readers could adopt, depending on their own trading styles.