Talking of removing lag, how about zero lag

Just a side note about removing lag, the key thing is the Time-Series you are 'de-lagging', i.e the concept of your indicator should be a 'fundamental' truth about the markets before smoothing it. I hate to be the one to break it but you guys are going to get nowhere removing lag from a MACD or Stoch on a data series that is not even stationary in the first place.

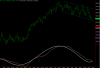

Attached is an eg of how I remove 'lag' from a 'Sentiment' Indicator that I calculate real-time.