Market: It was a nice come back. Lets wait for the follow through.

So can we say that the Key here is an unsuccessful attempt to breach the support levels, after a breakout?

--- Ya. We are looking for a pull back. We want to make sure that pull back does not go back to previous point from where the breakout has happened. If it does, they call it a false breakout.

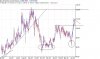

Kale Consultants at 105

--- This stock has baggage. Look at the chart for 7 years.

Currently, the stock has taken out 103 short term resistance. It has another resistance at 120. A six month chart shows a pattern called "Cup and Handle" with 2 bottoms at around 80 level. Look at how much time it took to go to 80 second time (almost 3 months) versus, how much time it took to come up to 103 (2 weeks).

Its not an ideal chart I would recommend. But, there is something going on for the stock. If you believe in Cup and Handle pattern, please wait for the handle (pull back) to form. Give it couple of days to enter above the pull back. Make sure it does not go below 103 when U enter.

So can we say that the Key here is an unsuccessful attempt to breach the support levels, after a breakout?

--- Ya. We are looking for a pull back. We want to make sure that pull back does not go back to previous point from where the breakout has happened. If it does, they call it a false breakout.

Kale Consultants at 105

--- This stock has baggage. Look at the chart for 7 years.

Currently, the stock has taken out 103 short term resistance. It has another resistance at 120. A six month chart shows a pattern called "Cup and Handle" with 2 bottoms at around 80 level. Look at how much time it took to go to 80 second time (almost 3 months) versus, how much time it took to come up to 103 (2 weeks).

Its not an ideal chart I would recommend. But, there is something going on for the stock. If you believe in Cup and Handle pattern, please wait for the handle (pull back) to form. Give it couple of days to enter above the pull back. Make sure it does not go below 103 when U enter.

Attachments

-

54.9 KB Views: 67