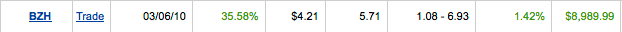

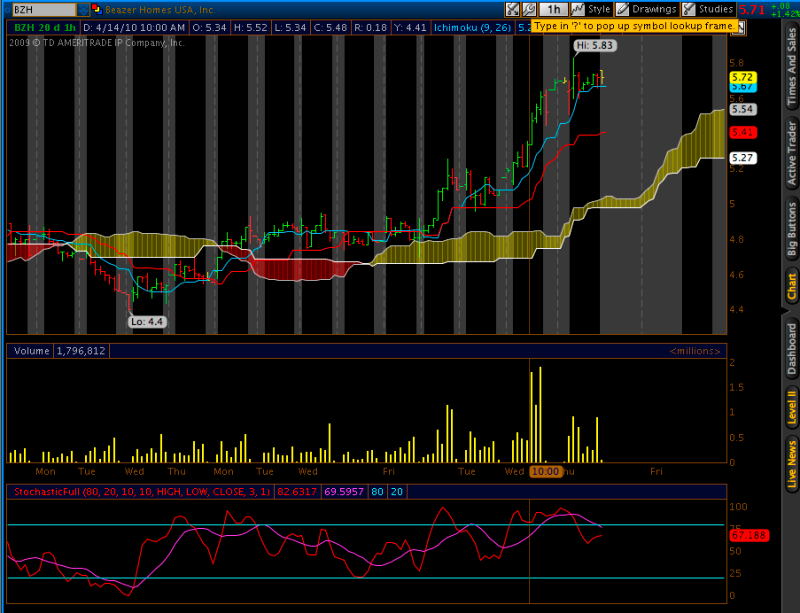

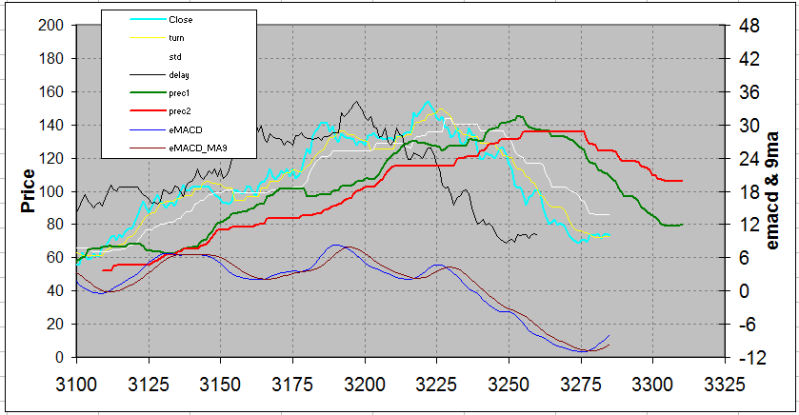

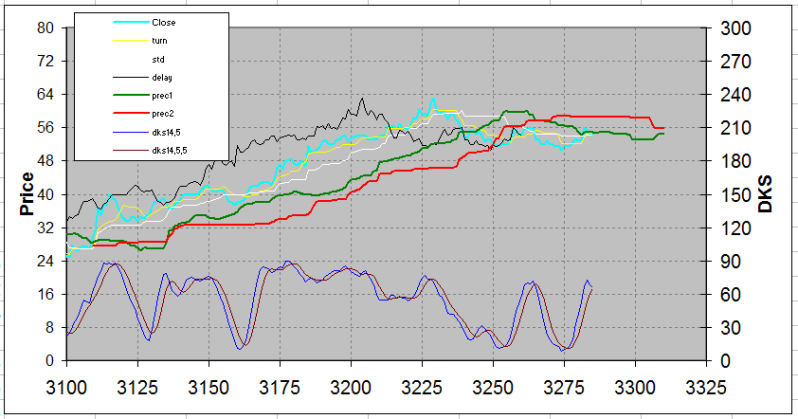

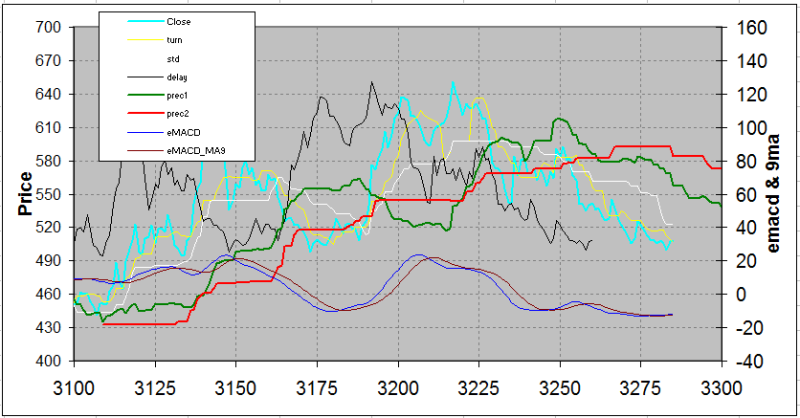

I have tried to find ichimoku setups and got 3 within last 3-4 days. Setups for BPCL and DHAMPURSUGAR are based on closing price going above TS (I am using macd signal line with 9MA in place of trix. They are the same) whereas the setup for sundaram fasteners is for TS crossing above KS and stochastics is shown in this chart.

BPCL: chikou span is away from price. proxy of trix (eMACD with 9MA) seems to be rolling up. see one whipsaw on this a few days ago around day 3250.

Dhampur sugar: longish downtrend recently.

Sundaram fasteners: price testing bottom of cloud which is narrowed in future projection.

CTJ, could you please give analysis of these scrips if convenient.

I notice a similarity of using trix with a setup which I use. I use emacd (12,26,9) and scan for it to start rising + downtrend (lower pivot lows, lower pivot highs) on EOD data based on 5-bar pivots. Buy point is above the most recent pivot high.

regards

vin

Images not loading. tried both imageshack and imagebam for uploading