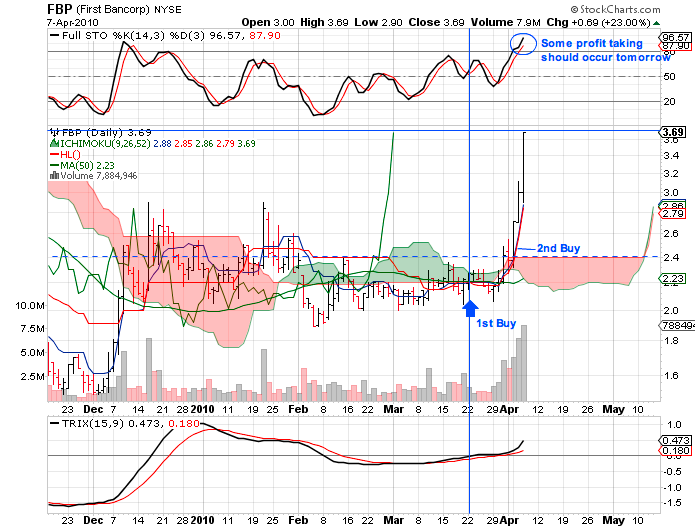

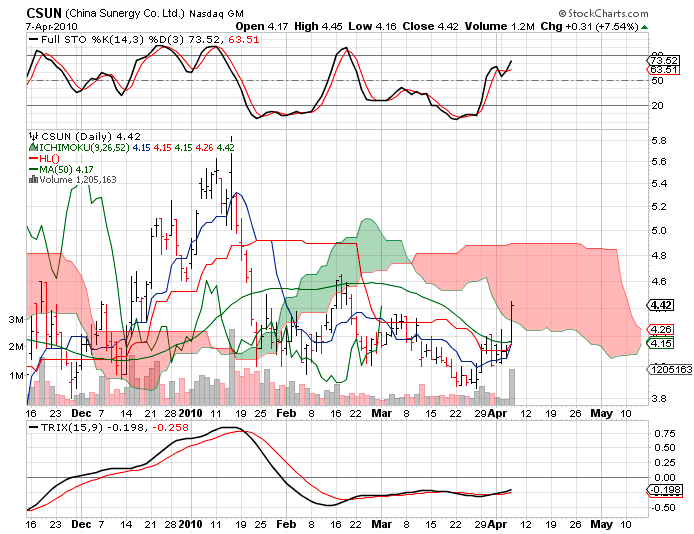

well it's looking great. Strong bull right but still below resistance. It's okay for price to close below TS as we can't expect price to always hold above the 9 day average on any bull run. However, I usually use TS as my stop/profit taking at the very end of a run when TRIX fast line has crossed back below TRIX slow line. IMO, TRIX works very well in conjunction with Ichimoku as it keeps us in trends without shaking us out early of our trade.

In the above chart, stochastics looks to be making a turn for the positive. If this holds, sensex should be able to break the current resistance of 17650.