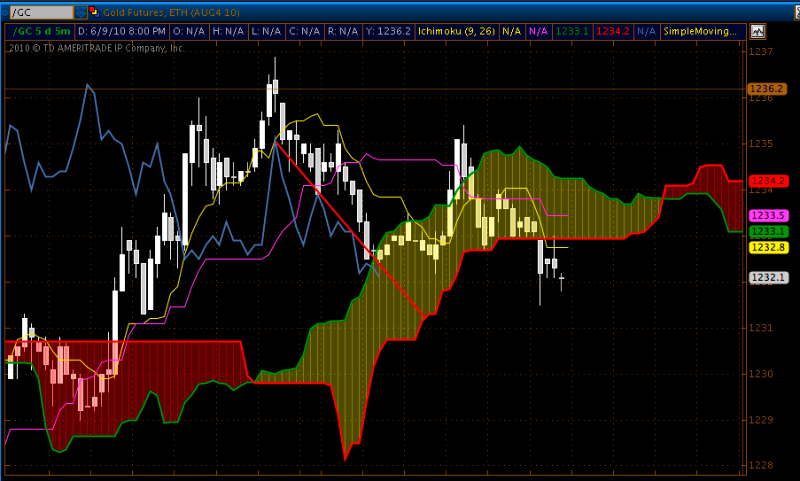

vinst, with whatever limited knowledge I have of Ichi, I think, the chart will always throw conflicting signals. What u have mentioned is not rocket science (plz don't get me wrong), they are bold in clear on the chart, price below x,and y and z, line y cross z, indicator crossing etc etc.

Important question is how to trade it.. What is our system to trade ? and interpret this chart wrt the system rule..

Say, if some is just following TS-KS cross over system.. then the person would have been short from bar # 3256 or so.. and if crossover happens again, now, then would be closing the position.

If someone wants to go and buy depeding on this ts-ks system, the clould is just above the entry level, which indicates lower probablity of success..

I think, the thread from Ankit had give some possible systems around 5 ichi lines.. In my view, that is more important for a trader.

In my simplistic style of trading, Any buysignal below cloud is not for me, so even if there are signs of it, i will stay away from it..

But if I get any new sellsignal then I will initiate short, or add to my previous shorts.

Cause cloud is supporting me with Short trades.

Will be waiting for others view on this.

Happy Trading

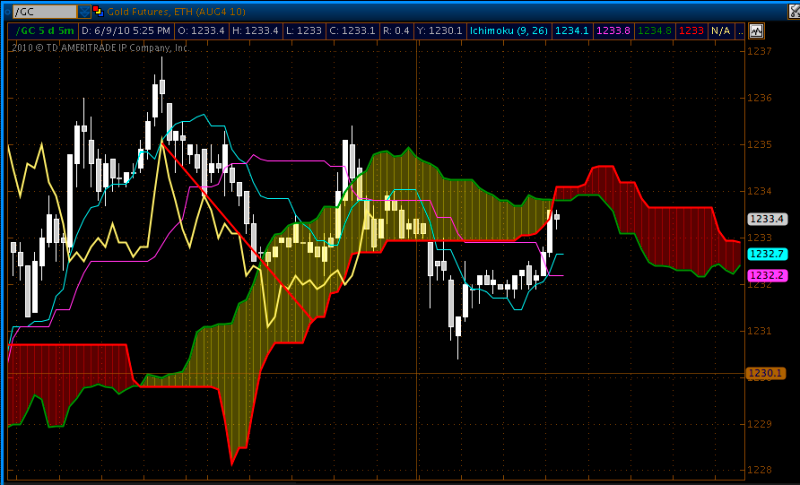

Important question is how to trade it.. What is our system to trade ? and interpret this chart wrt the system rule..

Say, if some is just following TS-KS cross over system.. then the person would have been short from bar # 3256 or so.. and if crossover happens again, now, then would be closing the position.

If someone wants to go and buy depeding on this ts-ks system, the clould is just above the entry level, which indicates lower probablity of success..

I think, the thread from Ankit had give some possible systems around 5 ichi lines.. In my view, that is more important for a trader.

In my simplistic style of trading, Any buysignal below cloud is not for me, so even if there are signs of it, i will stay away from it..

But if I get any new sellsignal then I will initiate short, or add to my previous shorts.

Cause cloud is supporting me with Short trades.

Will be waiting for others view on this.

Happy Trading