Hi folks - 3 consecutive whipsaws on 315 which is not uncommon or unforeseen. I got into longs on Friday after the bullish crossover.

I can see some questions being raised on 315 efficacy and that just simply trading crossovers is injurious to wealth etc ...I am very surprised to read such comments ...

First thing first ... everyone who has a working pair of eyes can see that the trading 315 between :

- Years 2000 to 2007 gave huge profits as it was a great bull run ...

- then came year 2008 where again 315 gave huge profits as in was a one way ride to hell for nifty .....

- Year 2009/10 again gave good profits as it was return of the bulls

- Year 2011 to 2013 has been the toughest period for trend traders given we started year 2011 around 6000 levels and even after 3 years we are still around 6000 levels ...i.e no big rise or fall like previous 10 years ....

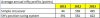

So to judge the efficacy of 315, lets use these toughest 3 years to judge the strategy ....and lets judge it based on only simple crossovers entries and exits which the crudest method of trading this sytem ...

So again I re-iterate, use the most non-trending period of mkts in last 13 years and then use the crudest method of using 315 to find out if any year ended in a net loss?

Next post lets talk about the actual performance of last 3 years.

Cheers

SH

I can see some questions being raised on 315 efficacy and that just simply trading crossovers is injurious to wealth etc ...I am very surprised to read such comments ...

First thing first ... everyone who has a working pair of eyes can see that the trading 315 between :

- Years 2000 to 2007 gave huge profits as it was a great bull run ...

- then came year 2008 where again 315 gave huge profits as in was a one way ride to hell for nifty .....

- Year 2009/10 again gave good profits as it was return of the bulls

- Year 2011 to 2013 has been the toughest period for trend traders given we started year 2011 around 6000 levels and even after 3 years we are still around 6000 levels ...i.e no big rise or fall like previous 10 years ....

So to judge the efficacy of 315, lets use these toughest 3 years to judge the strategy ....and lets judge it based on only simple crossovers entries and exits which the crudest method of trading this sytem ...

So again I re-iterate, use the most non-trending period of mkts in last 13 years and then use the crudest method of using 315 to find out if any year ended in a net loss?

Next post lets talk about the actual performance of last 3 years.

Cheers

SH