Hi Saint,

I am new to technical analysis and I am trying to learn it reading this great thread of yours. I an looking for your insight into the script that I bought few days back.

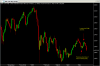

If I read the charts correctly both weekly and daily charts were in uptrend on 20th May. I took my position aftert the previous pivot high (309) was taken out on daily charts. I bought at 320 thought it was late. I calculated Stop-loss as 267.1-1.1= 266.

It started to move downwards since 21st.

I would really be thankful if you can answer my following queries:

1) rights and wrongs that I did in the process of buying this script and

2) how about entering immediately after a higher pivot low has formed instead of waiting for previous pivot high to be taken out?

Thank-You,

Anil

Hi Anil,

Welcome to Traderji!

The right entry point in CAIRN would have been Apr 10th and all the rest were adds..........let us presume,as is your case,that you were trying to get into Cairn,you would have to buy the rally once previous pivot highs on the daily was taken out,which happened on 20th......your stop would be the low of 15th ie 267.Since this move is getting vertical,your stop would be the low of the candle 2 bars from the high ie 287.........So far you are yet to be stopped.......

Ques 1:Nothing wrong in the entry except that in an ideal situation,your entry would have actually been in April 2nd week........and one more indicator next time,don't buy when you notice the trendlines getting steeper,the gradient getting steeper,more volumes coming in after an uptrend.......buying at this point is a calculated risk,as is most of the time in trading......If it goes on to make new highs,great.Else,adhere to your stops if hit.

About Ques 2........nope on buying at pivot lows......Buy once newer pivot highs are made......Simply because at higher pivot lows,you do not know if this is just a decline or the start of a downtrend.Guessing that this is nothing but a pullback and not a downtrend can be dangerous.........

Saint