Re: Queries From students of Saint

Hello Everybody,

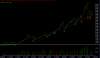

I am a long term investor, but i want to keep track of important long term trend reversals to ensure that i exit at the right time. I have invested in the indian stock market using some good mutual funds. I have been tracking the sensex's long term chart based on the saint's thread to ensure that the sensex continues to be in a long term untrend while i am invested. Also I had done a trendline on the sensex chart to ensure timely exit in case the trendline is broken.

Have a look at the chart attached. Clearly the long term trendline that i was following is broken. So i have booked some profits in my MF portfolio aleardy. But the last pivot low PL1 is still greater then the one before it (PL2) i.e. PL1 > PL2. So the uptrend is still not broken? There is no new pivot high that has been formed after PH1 according to me, so we wil need to wait and see if the new pivot high is lower then PH1 to confirm if the uptread is broken.

My dilemma is how do I confirm that a new pivot high is formed? I want to exit my remaining position if the pivot high is lower then PH1. Is there a way to know how much time it may take to form a new pivot high and how do we confirm that a pivot high is formed.

I have marked other Pivot High and Pivot Lows based on my understanding of the chart. You are welcome to correct the same.

All comments welcome.

Sachin

Hi Sachin,

First it's important to analyse if you are trading the weekly charts......which means we honour previous pivot lows and highs on the weekly charts......If it's the weekly pivot low that you are looking at,the last pivot low before the dntrend was on the week ending 20/12/07 at 5676.70.....If and when this pivot breaks,the uptrend is over......No such thing as making lower pivot highs to confirm the end of an uptrend......Break of prev pivot lows and you are out of that trade.

On the other hand,if you are a long term trader,benefitting from the Primary Uptrend,your entry was in July 2003 and still in the trade.........If lower pivot highs are made and then previous pivot lows are broken at 4468,your trade that started at 1140 would have come to an end as the Bear takes over.

And if you were trading the weekly chart uptrend using the monthly as backdrop,then again you would have exitted in the third week of Dec and probably reentering soon once 5300 is taken out.

Any of the ways,the break of previous pivot lows is the end of that uptrend on that time frame........no more confirmation is required.

And remember,in an uptrend we are looking at previous pivot lows.......in a dntrend we are looking prev pivot highs........Break of pivot lows is what we are looking for to exit.

Hope this helps to clear some doubts........do get back if doubts persist.

All the best!

Saint