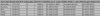

I did some analysis of my intraday Nifty Futures trades . My success ratio is 55 %. So in every 2 trades I win 1 trade and loose on 1 trade. In loosing trades I have included those trades in which I got out early( scratch trades where I got out in 3-4 points ) as per my trading system though the trade may not have hit the stoploss. My average loosing trade is 8 points and average winning trade is 24 points. I normally have 2 trades in a day...sometimes 3 or 4 . Assuming 2 trades in a day and one looser and one winner, my average points per day in Nfity futures come to 24-8 = 16 points

The figures above are average figures.This data I worked on 3 months so the sample size is not very large to get any definite trends, but thought it may help you.

Smart_trade

The figures above are average figures.This data I worked on 3 months so the sample size is not very large to get any definite trends, but thought it may help you.

Smart_trade

Dear Smartrade

thanks for sharing the info...

considering the small drawdowns, 16points/per day is very good indeed.. :clap: