For last two days I was away from live trading, as I have something more important to attend before I start live. That is backtesting. This should have been ended before I started from 16th Aug, or may be I should have started only after finishing this. But I guess it does not matter any more when I am starting as the end date is fixed. So it is just a matter of building confidence in what I am doing.

The backtesting was done manually bar by bar in Amirboker auto play with time interval set as 1 sec. So one day took nearly 6+ hours to complete. This was close to the real time market that I could go with. I had to go through the times of waiting for a setup with patience and had to wait for a candle close to make a decision. Though it was painful, but I am glad I finished it.

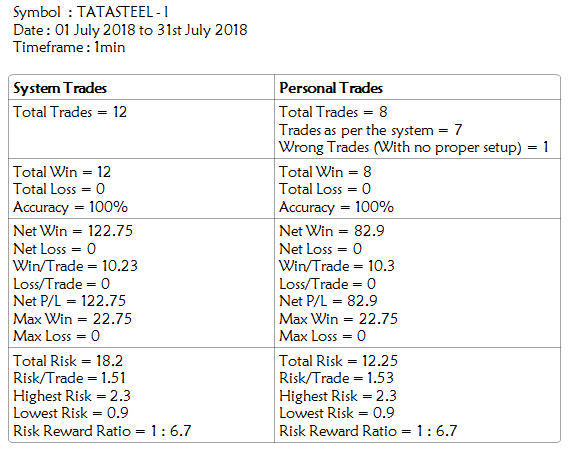

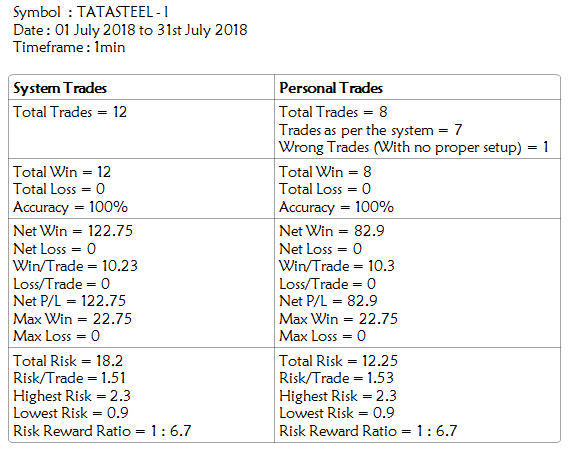

I double checked all my trades and checklist for trades taken and areas where there are no trades to ensure I am not doing anything wrong as It was hard for me to believe that I had no loosing trades for that month. TATASTEEL moved quite good for intraday in the month of July with no ambiguity in directional bias, so I guess the performance justifies it. I am in no way advocating that my system does not make loss, I am sure it does and it will, and I am waiting for that. I will start testing BANKNIFTY for august 2018 next in same approach as this is trading in a tight range so far and experienced traders like @XRAY27, @VJAY has reported loss. May be that will test my strategy and my approach even more and make it better.

In the simulation there was no brokerage and commissions are applied, slippage during entry/exits are factored in, But I had used a filter of 0.1 during both entry and exit. So real output will be lesser that what I shown in the table.

The backtesting was done manually bar by bar in Amirboker auto play with time interval set as 1 sec. So one day took nearly 6+ hours to complete. This was close to the real time market that I could go with. I had to go through the times of waiting for a setup with patience and had to wait for a candle close to make a decision. Though it was painful, but I am glad I finished it.

I double checked all my trades and checklist for trades taken and areas where there are no trades to ensure I am not doing anything wrong as It was hard for me to believe that I had no loosing trades for that month. TATASTEEL moved quite good for intraday in the month of July with no ambiguity in directional bias, so I guess the performance justifies it. I am in no way advocating that my system does not make loss, I am sure it does and it will, and I am waiting for that. I will start testing BANKNIFTY for august 2018 next in same approach as this is trading in a tight range so far and experienced traders like @XRAY27, @VJAY has reported loss. May be that will test my strategy and my approach even more and make it better.

In the simulation there was no brokerage and commissions are applied, slippage during entry/exits are factored in, But I had used a filter of 0.1 during both entry and exit. So real output will be lesser that what I shown in the table.