hi amitt,

...........

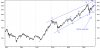

if this be the result on a day like this, where not only negative sentiment prevails but also at levels, as high like this, don't you think its high time we say "NO NEED OF CAUTION".

mundane things says a lot more. but till then ..........

cheers,

jdm.

...........

if this be the result on a day like this, where not only negative sentiment prevails but also at levels, as high like this, don't you think its high time we say "NO NEED OF CAUTION".

mundane things says a lot more. but till then ..........

cheers,

jdm.

Was wondering what would your exploration have shown from Monday 8th May to Wednusday 10th May 2006.

But some how i feel, same conclusions would be drawn then "NO NEED OF CAUTION".

@ Amit

When can/will we finally put behind (invalidate) this Wave B thingy? or will it only be confirmed after 3800? (if at all)

Regards

Sanjay

Last edited: