Here's a couple of things you need to know:

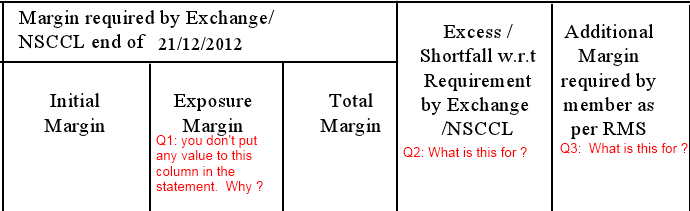

Initial Margin is the same as SPAN Margin.

correct.

Exposure Margin is the same as Additional Margin.

SPAN margin , Exposure margin are collected by the Exchange...Broker needs to collect these from client and pass it to Exchange ...... but Additional Margin are taken by Broker and can be kept with them for their risk management.

Q1- Exposure Margin is charged only for a Future Contract. Hence if you have taken a Future position, Exposure margin will be blocked.

I take Future Contract ...In the Daily Statement , I find you don't block any Exposure margin ! and hence I'm surprised

(you block some margin in "Additional Margin required by Member as per RMS" column though)

Q2- In case the margin required by NSE (Initial Margin) is Rs. 20,000 and the margin available is lesser than Rs 20,000 this column will show the shortfall amount.

In case there is any shortfall, there will be a penalty charged.

penalty ? I think your policy was...if margin shortfall , then broker will square off/liquidate the position ...is not it ? or you really want to penalize 18% per annum charge.

by the way , as per newly formatted Statement , Margin Shortfall column will always show negative because you show -negative funds here for blockage and we can not allocate separate fund for F&O segment.....real funds are lying in the Equity segment. I guess this should not be a problem as long as Overall Margin Balance is positive.

Q3- There are times when the broker may decide to levy margins over and higher than what is being levied by the Exchange. In case there is any such margins, it would show here.

Fine .....no issue.